1603 for the first quarter 2018 will appear as an open case in the BIR’s records. 0605) to remit the 35% FBT, do not be surprised if the failure to file BIR Form No.

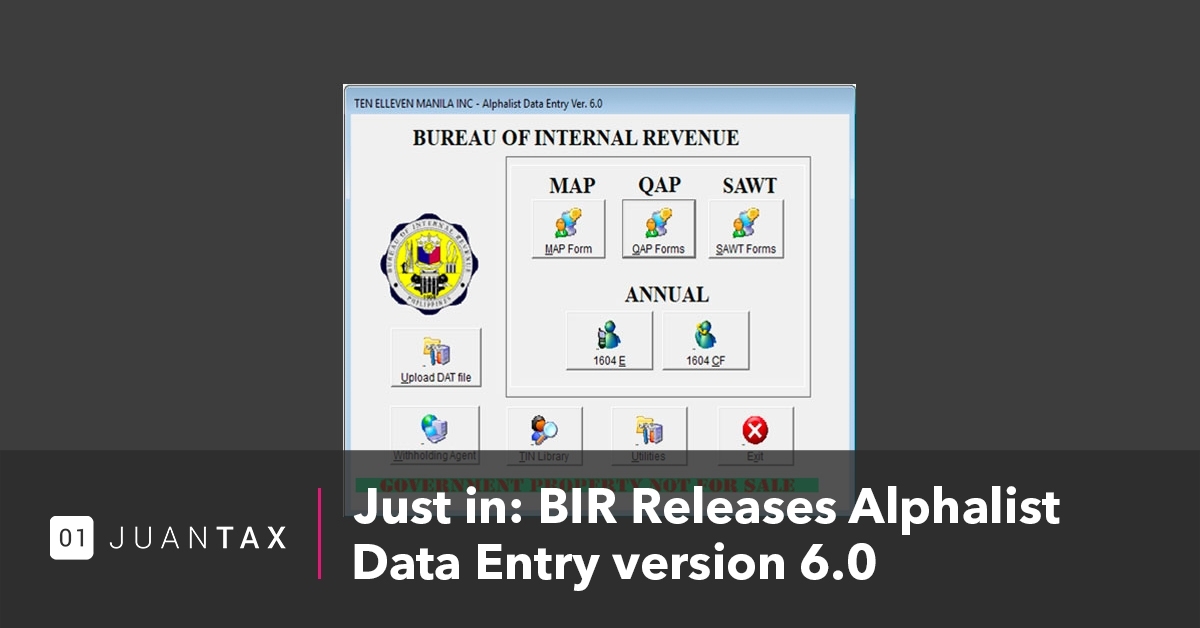

#1604CF EXCEL FORMAT HOW TO#

Thus, many taxpayers are at a loss on how to remit FBT for the first quarter of 2018. 1603 became available only during the second quarter of 2018. 28-2018, taxpayers were advised to disregard the penalties computed by the system and pay only the basic tax due, provided that the payment shall be made on or before the last day of the month. Through Revenue Memorandum Circular (RMC) No. Thus, if a taxpayer will file after the old deadline (15th day after the end of the quarter), penalties for late filing and/or payment will be automatically computed. The deadline for filing and payment, however, has not been updated. 1603 is being used, wherein the tax rate has been revised to 35%.

For Electronic Filing and Payment System (EFPS) users, an enhanced BIR Form No.

#1604CF EXCEL FORMAT MANUAL#

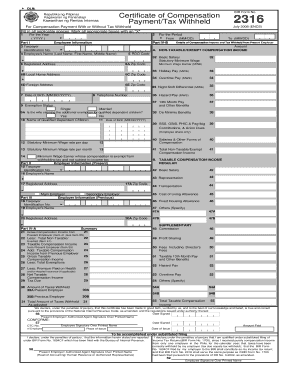

1603Q) is already available for manual filers. The fringe benefits tax (FBT) rate was increased from 32% to 35%, and the deadline for filing and payment was moved to the last day of the month after the close of the calendar quarter. Here are some of the updates already available and workaround procedures to guide you.įringe Benefits Tax (BIR Form No. To be fair, the BIR actually issued many circulars and advisories to inform taxpayers about the workaround procedures during the transition period. As a result, many taxpayers are having difficulties in trying to comply and keep up with the new rules. More than a year after the passage of the TRAIN Law, however, the necessary updates are not yet fully in place.

#1604CF EXCEL FORMAT UPDATE#

Some of these changes are the streamlined filing of tax returns, adjustments to tax payment deadlines, and revision of tax rates, the implementation of which requires the Bureau of Internal Revenue (BIR) to update its system and issue revised tax returns. Aligned with the said objectives, the first package of the CTRP or the Tax Reform for Acceleration and Inclusion (TRAIN) Law brought many changes on the overall tax compliance procedures.

The comprehensive tax reform program (CTRP) was envisioned to redesign the Philippine tax system to be simpler, fairer and more efficient.

0 kommentar(er)

0 kommentar(er)